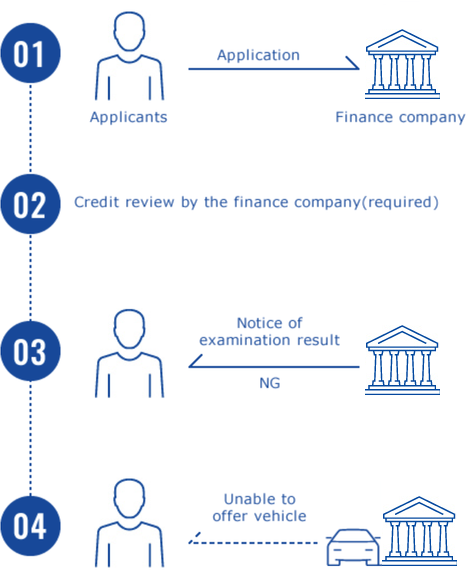

In Southeast Asia, private banking plays a significant role as a financial intermediary. However, domestic banks across the region do not respond well enough to the strong need for finance in the communities they serve. One of the main causes behind this is the problem of “information asymmetry,” whereby financial institutions lack adequate information on borrowing firms and are faced with high costs for information gathering, resulting in lack of their access to finance. This is particularly the case for micro, small and medium enterprises (MSMEs), which play a crucial role in most economies, accounting for 97% of all enterprises in Southeast Asia.

This issue extends to all types of loans, including vehicle loans, whereby those in mobility-related work are not able to apply for vehicle loans and cannot own vehicles. Left with no choice, they end up renting cheap vehicles, which are typically old and bad for the environment.

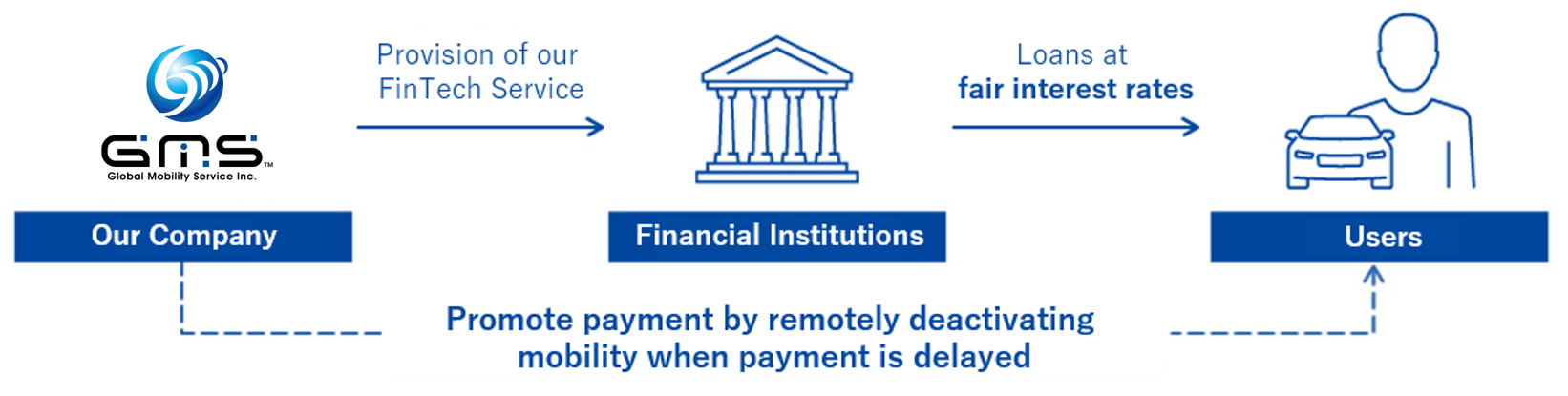

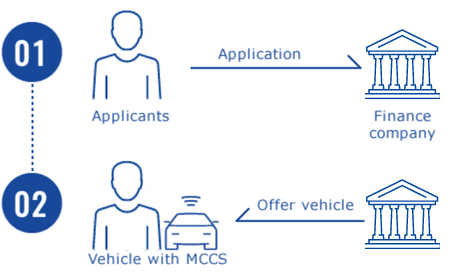

Against this background, GMS Inc.® aims to provide an opportunity for the unbanked, linking them with financial institutions and auto dealers. The unbanked will be able to access vehicle loans and will be able to own environmentally friendly and affordable vehicles.

Since we started our operations in the Philippines, we have been able to improve living standards of the unbanked, while taking into consideration the impact of vehicle emissions, and our story does not end here. Since opening a branch in the Philippines, we are now operating in Cambodia, Indonesia and Japan. In the future, we plan to expand further in ASEAN-member countries and beyond.